The Citron Research website has been around for a number of years. It first came to my attention roughly five years ago when I was approached with an idea to make short trades based on their blog posts. That idea never panned out as the stocks they wrote about weren’t very liquid, and therefore the risk/reward didn’t make sense to me. Fast forward to 2015 and they were writing about short opportunities in large cap stocks.

Citron and several others became very vocal about shorting Valeant Pharmaceuticals, a company that was a popular long position among larger hedge funds, and Bill Ackman in particular. Andrew Left, the owner/founder of Citron began making the rounds on financial television and received some notoriety once Valeant stock began to collapse in the fourth quarter of 2015. Citron is an unregulated entity so there is no way of knowing how many shares Left was short of VRX or when he placed his trades.

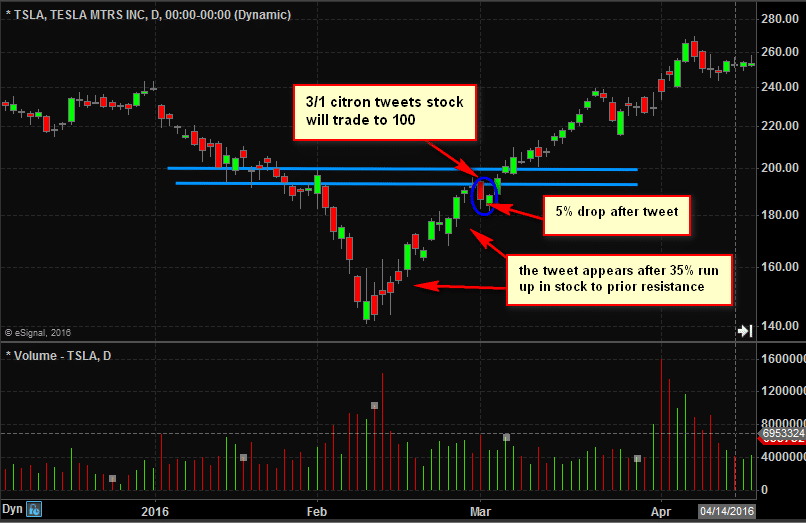

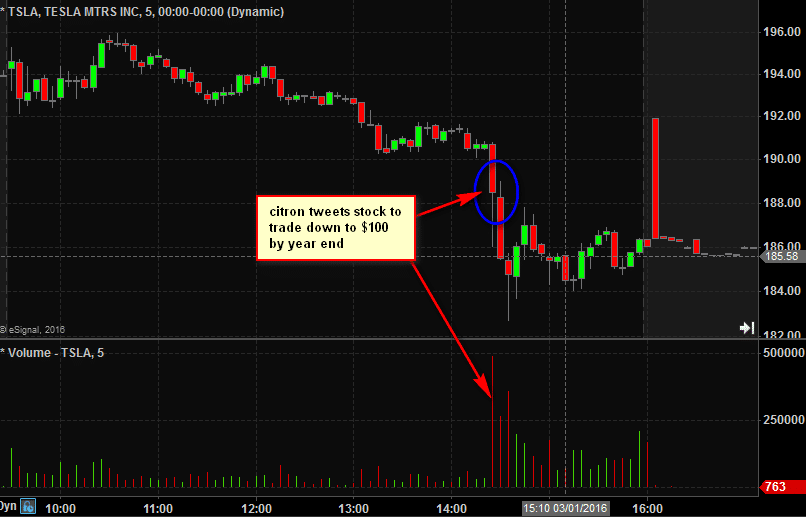

In 2016 Left continued to push short ideas in mainstream large cap stocks. He appeared on financial television suggesting that Tesla, Facebook and recently Valeant once again as shorts. I happen to follow all three stocks closely as they are good short term trading vehicles. I believe a pattern emerged. Left would appear on television shortly after a “run up” in a stock and declare that he was short. The stock would immediately trade lower that day and possibly the next.

Left has been involved in markets for two decades and is well aware that his television appearances will move the stocks that he discusses. There is a famous insider trading case from 1980s, prosecuted by Rudy Giuliani, that involved a Wall Street Journal columnist going to jail for placing trades prior to a market moving catalyst that he would create. Has Left’s appearances on CNBC or Bloomberg caused stocks to move similar to the WSJ case? Is he placing trades immediately before and after the appearances in violation of the 1934 Securities Act, and the case law derived from that law? That is something for an SEC staff attorney to decide. Here are a few examples for them to consider.

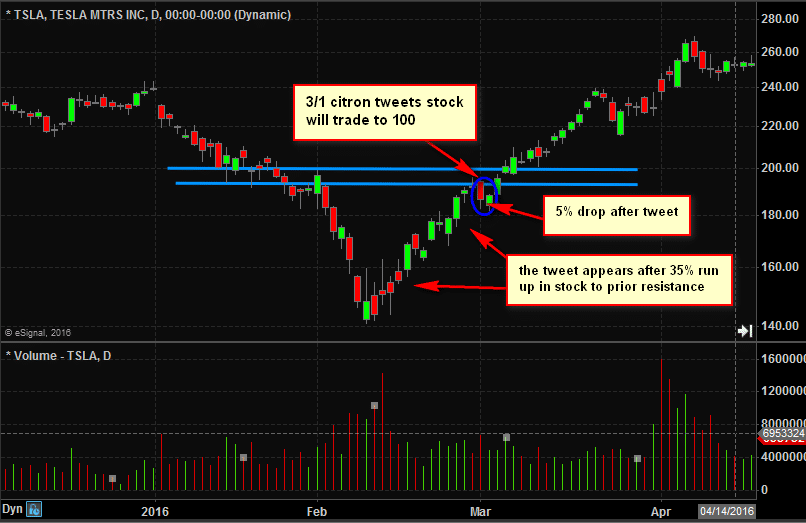

Citron shorting $TSLA Supply AND demand problems should take down to $100 by years end. News flow all around does not look good for stock

— Citron Research (@CitronResearch) March 1, 2016

Immediately following the tweet TSLA volume spiked and the stock traded lower. Did Left use this drop or the lower open the next morning to cover his short position? That is something for the SEC to look at. As you can see from his tweet he suggests this is a longer term idea suggesting the stock could drop by almost 50% by year end. Currently, TSLA is about 20% higher when he suggested a short position.

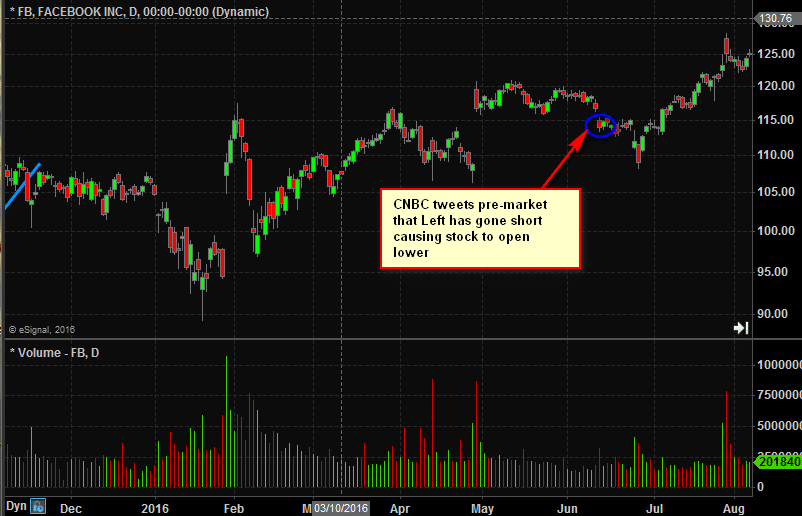

BREAKING: Citron’s Andrew Left is shorting Facebook https://t.co/GwMeTUpPjd • $FB

— CNBC Now (@CNBCnow) June 13, 2016

Facebook was trading just below its all time high when Left appeared on CNBC to push his short idea. Again we saw a volume spike and a drop in share price. Since then it has reported earnings and is trading roughly 10% higher.

His most recent idea was to get short Valeant saying it would likely trade to zero to CNBC. The stock had just run up about 20% from its 2016 low when he pushed this idea. The stock is now trading higher.

As a trader I recognize his timing on these calls as the stocks have recently moved higher with well defined resistance. By appearing on TV he can cause quick declines in the stock price potentially exiting some or all of his positions at better prices.

Citron calling $VRX a $0 now

— Quoth the Raven (@QTRResearch) July 13, 2016

Three examples of very liquid large cap stocks that Citron Research was able to cause short term down moves in. The timing of Left’s trades before and after his pushing the ideas on CNBC, Bloomberg and social media would determine if he illegally profited. Left has been involved in the securities markets for two decades and was fined twice early in his career according to his Wikipedia page. If I were a staff attorney at the SEC I would be asking questions.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 20 years. His email address is: [email protected].

No relevant positions