SMB will be hosting a free webinar on October 6th where I will outline several trades based on techniques taught in the Vault.

In my last post, I mentioned the Power of Mechanical Process – Today, we’ll discuss the Power of Trade Reliability by this trade review

One of the byproducts of strong mechanical process is Trade Reliability.

When a chart builds a familiar pattern, revisits a structure that holds a high probability formation, we can act with purpose.

Here’s an example and a reliable concept that we teach in The Trading Vault that you can watch unfold over the coming days and weeks-

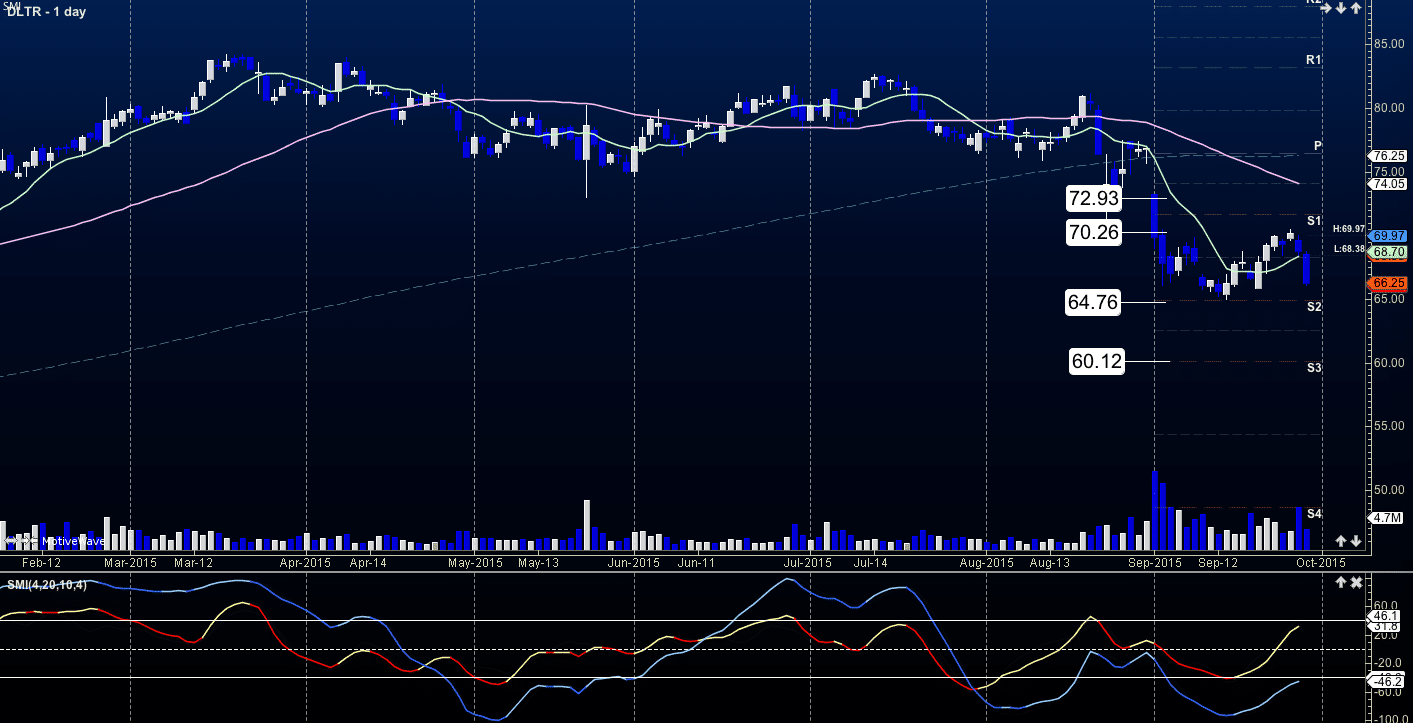

DLTR – we’ll stage this trade example for illustrative purposes using options – I will discuss more about this particular option strategy most useful when looking at value events – and value stocks – in our webinar on October 6.

Dollar Tree presents us with a value event trade and is a swing trade setup that may run as little a few days but might run into several weeks, depending on chart volatility –

Established support levels are near 65 – lower support lies near 60 – our targets are above near 70.2 and 72.9 but with the option setup around short puts, we will still be profitable even if we do not approach those levels. A chart like this will rotate so we may see a pullback before a bounce, or if it bounces first, it will pull back – either way, we will capitalize on the fact that the chart is near an important support zone.

The price zone we will retest is 65 – support level below that is 60

The strategy suggests an out of the money short put, or short put spread if an account does not have sufficient margin to engage.

Here’s one potential trade – short Nov 65/60 put spread at 1.45 – breakeven price at expiration 63.55 – if the chart holds, we will move nicely into the upside target of 70 –

Another trade that utilizes margin is the short Nov 65 puts, currently at 2.45 – breakeven price at expiration 62.55- giving us a bit more room to make money.

If the chart loses 65 and heads to 60, I will still anticipate a bounce region near my breakeven price into 63.55, which will still give us a region to make money.

If the chart weakens, we will see a weak retest of 65, if it loses the area, and this will trigger us leaving the trade early. I will update the chart as it progresses, so that we can watch it unfold.

Reliable support is often retested – this is the simple but valid cornerstone of this kind of trade. If you’d like to learn more about this as the trade unfolds and how you can implement the trade, join us for a free webinar on October 6th

No relevant positions