Trading Vault Concept –

“When charts are in a trend, we are often tempted to pick bottoms or tops because we FEEL a chart has reversed enough. The slightest drift over or under a level, we trigger our trades to initiate a trade in the direction of the move, but in these markets breakout and breakdown levels are part of a wave retracement event, not an isolated event. If the chart does not hold its retracement, the move is failed. This can keep me out of bad trades and failed moves. Learning to implement a strategy that uses this market behavior is essential to consistent trading results”

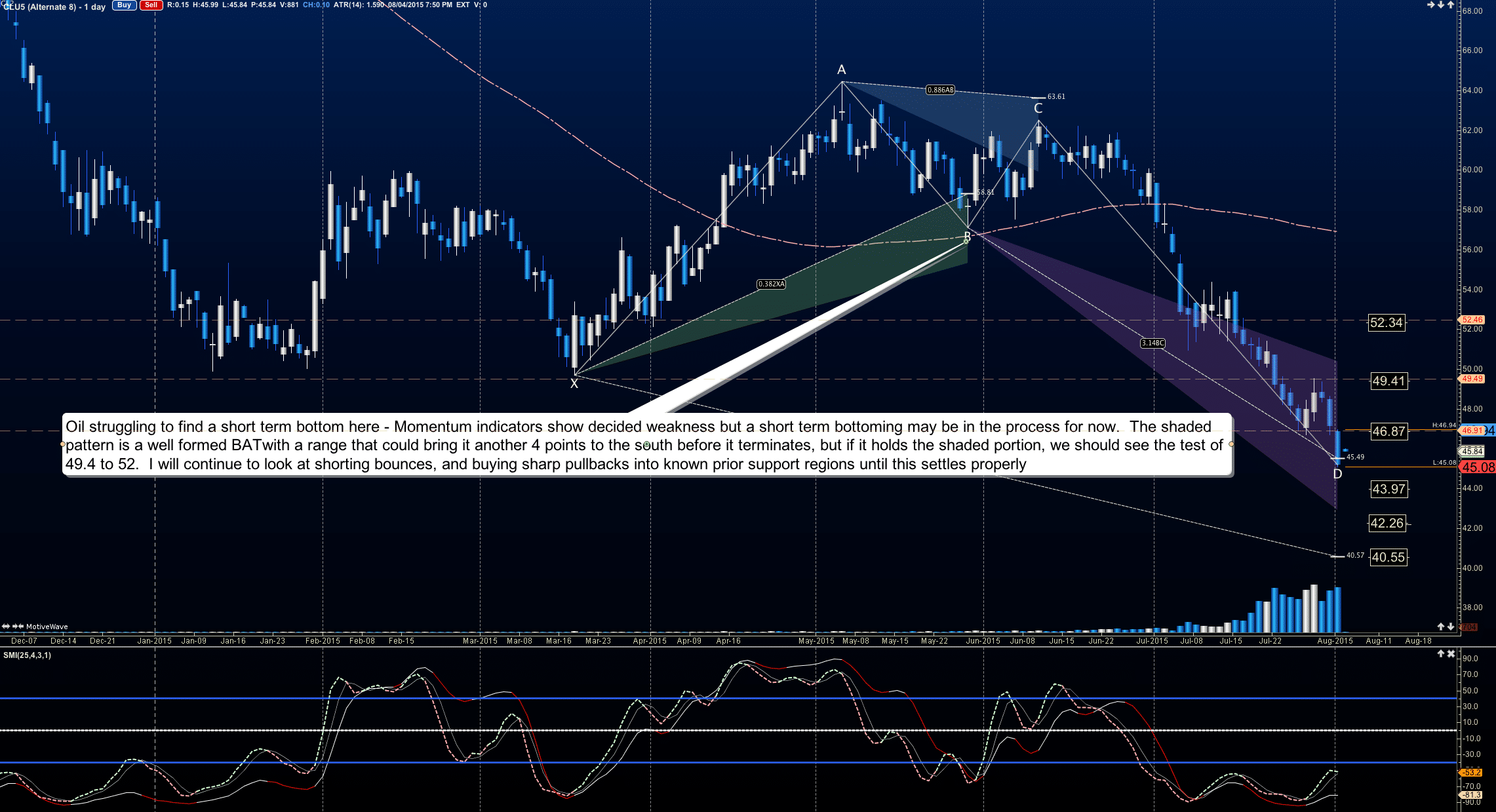

Let’s take a look at the WTI crude chart – August’s contract in particular

Buyers are trying to find a bottom in the face of extremely negative momentum, only to keep getting rejected. The price failure is trapping longs (buyers in the wrong direction) in the downward motion controlled by the sellers. I like to use the 4hour chart to strategize my trades and using the Trading Vault concept above, I am looking today at 46.12 as a breach point for another upside press into resistance into 46.8 and perhaps 47.30….. This move should not hold and as momentum is negative as mentioned, we should retrace to our initial breach point.

On the down side, we haven’t seen these levels in oil since 2009 ( outside our last drift down in March), so in order to find support, we have to look at the cumulative contract for WTI. I’m looking at 45.77 to open up further downside and a retest of 45.45. A loss of 45.2 and we’re likely to see 44.74, 44.3, 43.65, 42.6 and may settle in at 41.6.

* no relevant positions