I am going to suggest something today that will probably make 98% of our readers think I am completely insane… and the other 2% will only think I might be insane. Still, this one thing has done more to advance my chart reading than anything else I have done in 15 years of trading. Though it is time consuming and is probably one of the oldest of the “old school” practices, I have found great value in keeping price charts by hand.

When I started trading, I didn’t use a chart service or a computer program. There certainly were charts available, I just didn’t know enough to know I needed them or even where to find them. Instead, I had a newspaper and graph paper and every day I would add one price bar to my charts for coffee, sugar, grains, meats and metal futures. After doing this for a while, I did eventually get a charting service, but I am sure those first few months of charting by hand laid the foundation for understanding the action behind the charts.

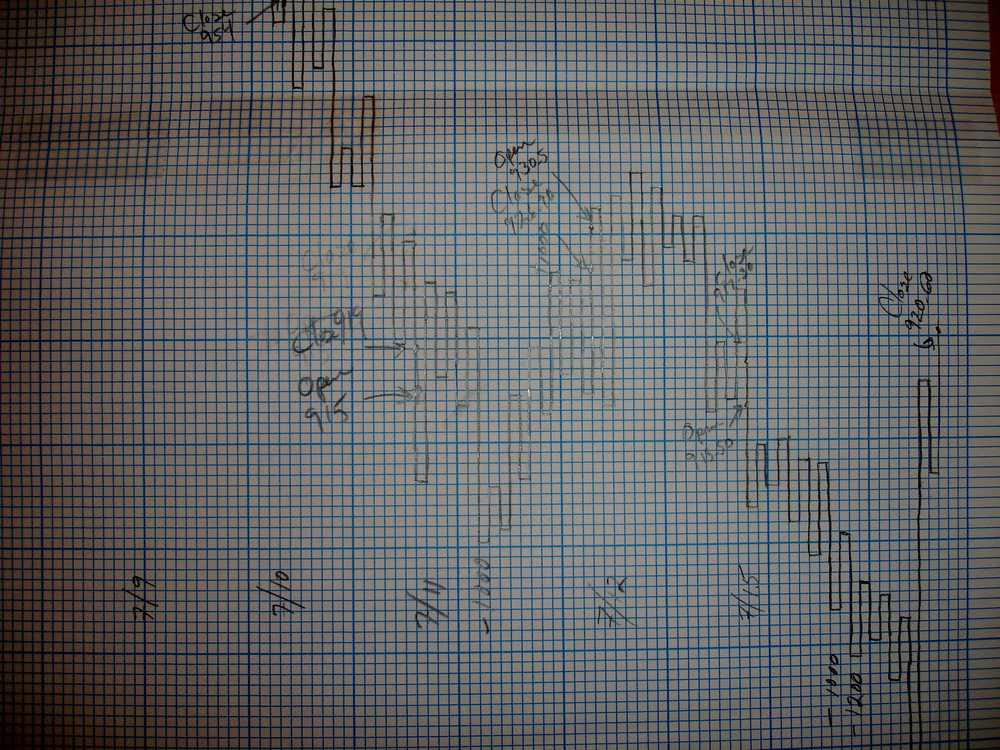

Several years later, I had made the transition to daytrading S&P futures and was struggling to make it work. My mentor at the time suggested I take a step back and start keeping a five-minute swing chart of the ES futures by hand every day, and so it began. For the next year and a half, I graphed every single move of the market by hand. This required complete focus, and, most importantly, me sitting at the desk every minute the market was open paying attention to prices on the screen. What began on a single piece of graph paper grew, after much taping and stapling, into a leviathan monster that coiled multiple times around the walls of my home office. (It helps to have an understanding family if you are going to try a stunt like this!)

The specifics don’t matter, but you must have a consistent methodology for defining the swings. (There’s that word “consistent” again… interesting it keeps showing up in these posts, isn’t it?) For the charts I was drawing at the time, I was defining a swing as a move a certain percentage of intraday ATR off a swing high and low. So, for instance, once the market came off a high by a distance equal to 3 average bar ranges, I would draw a line on the chart and then wait for price to bounce three ranges off a low point to draw the next line. If you choose to try this, you can use a system like this, but it is just as useful to keep simple bar charts or point and figure charts.

Why in the world would anyone do this? Well, first of all, electronic charts make life too easy. It’s too easy to look at thousands of price bars a day on your screen and simply accept them for what they are, scanning for heads and shoulders or whatever pattern you want to give a shot this week. Pretty soon, your eyes just glaze over. Drawing lines by hand forces you to think about the buying and selling that is behind each move in the market. The act of picking up a pencil engages a different part of the brain and makes learning faster and more complete. This makes you pay attention in a deep, almost Zen, sense of the word. It is not enough that you are at your desk. You must really focus and be in the moment while you are trading. Keeping charts by hand encourages this state and enforces the kind of discipline needed for top-notch trading.

I am not saying this is the solution to all your trading problems, but I believe doing this taught me to read charts better than anything else I have done. At the very least, it’s a different perspective on the learning process—in the year 2010 you won’t hear many other people tell you to sit down at your computer and break out the graph paper! Enjoy the holiday weekend. We’ll return to the trend line posts in the middle of the week.

23 Comments on “Embracing the Value of Keeping Charts by Hand”

I found this idea to be very interesting and also very original. I am going to try this method starting with next weeks trading. Thank you.

I found this idea to be very interesting and also very original. I am going to try this method starting with next weeks trading. Thank you.

I know that Helene Meisler, an excellent technician at RealMoney, has always done all of her charts by hand. Her charting is on a daily frame, which allows her to keep many going simultaneously. And I recall that she keeps a variety of interesting market internals and ratios. Bottom line, though, is that she continues to keep those charts by hand because of the “feel” it gives her for the market, just as you’ve described.

I know that Helene Meisler, an excellent technician at RealMoney, has always done all of her charts by hand. Her charting is on a daily frame, which allows her to keep many going simultaneously. And I recall that she keeps a variety of interesting market internals and ratios. Bottom line, though, is that she continues to keep those charts by hand because of the “feel” it gives her for the market, just as you’ve described.

I recall having a chat or two about this “old school” practice. It is a technique employed for generations by teachers and it applies to virtually any subject matter. I believe this creates a “personalized” mental image that allows the brain to process information on a deeper level than if one only reads the chart. Thanks for the insight!

I recall having a chat or two about this “old school” practice. It is a technique employed for generations by teachers and it applies to virtually any subject matter. I believe this creates a “personalized” mental image that allows the brain to process information on a deeper level than if one only reads the chart. Thanks for the insight!

I recall having a chat or two about this “old school” practice. It is a technique employed for generations by teachers and it applies to virtually any subject matter. I believe this creates a “personalized” mental image that allows the brain to process information on a deeper level than if one only reads the chart. Thanks for the insight!

i graphed my morning of trading. it looks really pitiful. =T

i graphed my morning of trading. it looks really pitiful. =T

i graphed my morning of trading. it looks really pitiful. =T

Really helpins controlling overtrading on this choppy day. (Day 2 of graphing)

Really helpins controlling overtrading on this choppy day. (Day 2 of graphing)

Really helpins controlling overtrading on this choppy day. (Day 2 of graphing)

Adam,

Day 3 of graphing. It keeps my hands off the trigger when the market is not moving and focused on potential zones of trading. Was wondering if you’re still following this?

Adam,

Day 3 of graphing. It keeps my hands off the trigger when the market is not moving and focused on potential zones of trading. Was wondering if you’re still following this?

Adam,

Day 3 of graphing. It keeps my hands off the trigger when the market is not moving and focused on potential zones of trading. Was wondering if you’re still following this?

Hey Eric,

yeah i think that is one of the real values of this is that it gives us something to do. too often as traders we feel our job is to make trades…. so we make trades even when there is no good setup. doing something like this, or doing research, or reading, etc etc… anything constructive you can find to do will make you a better trader (and save you from ripping it up in worthless trades!)

Hey Eric,

yeah i think that is one of the real values of this is that it gives us something to do. too often as traders we feel our job is to make trades…. so we make trades even when there is no good setup. doing something like this, or doing research, or reading, etc etc… anything constructive you can find to do will make you a better trader (and save you from ripping it up in worthless trades!)

Hey Eric,

yeah i think that is one of the real values of this is that it gives us something to do. too often as traders we feel our job is to make trades…. so we make trades even when there is no good setup. doing something like this, or doing research, or reading, etc etc… anything constructive you can find to do will make you a better trader (and save you from ripping it up in worthless trades!)

oh awesome, I think this is one of the best things i’ve done to improve my trading. THANKS!!

oh awesome, I think this is one of the best things i’ve done to improve my trading. THANKS!!

oh awesome, I think this is one of the best things i’ve done to improve my trading. THANKS!!

Appreciation !