One of my favorite options spread trades is the Bearish Butterfly. I developed this trade a number of years ago in recognition of the fact that no matter how much the market may rally, it will eventually experience pullbacks. So an options spread trade, developed to take advantage of these periodic pullbacks should work in most market scenarios. In the very near future, SMB’s Options Training Program will be offering options traders a video series on exactly how to trade the bearish butterfly in every market condition. I have personally been trading this strategy myself for 4 years now, and have been very happy with the results.

Today’s post is the beginning in a series of posts in which we will demonstrate exactly how we are trading the December 2011 Bearish Butterfly so that you can get a feel for the design and flexibility of this trade. I entered the trade 56 days out from the December 2011 monthly options expiration which was last Friday and modified the position, according to our plan, on Monday of this week.

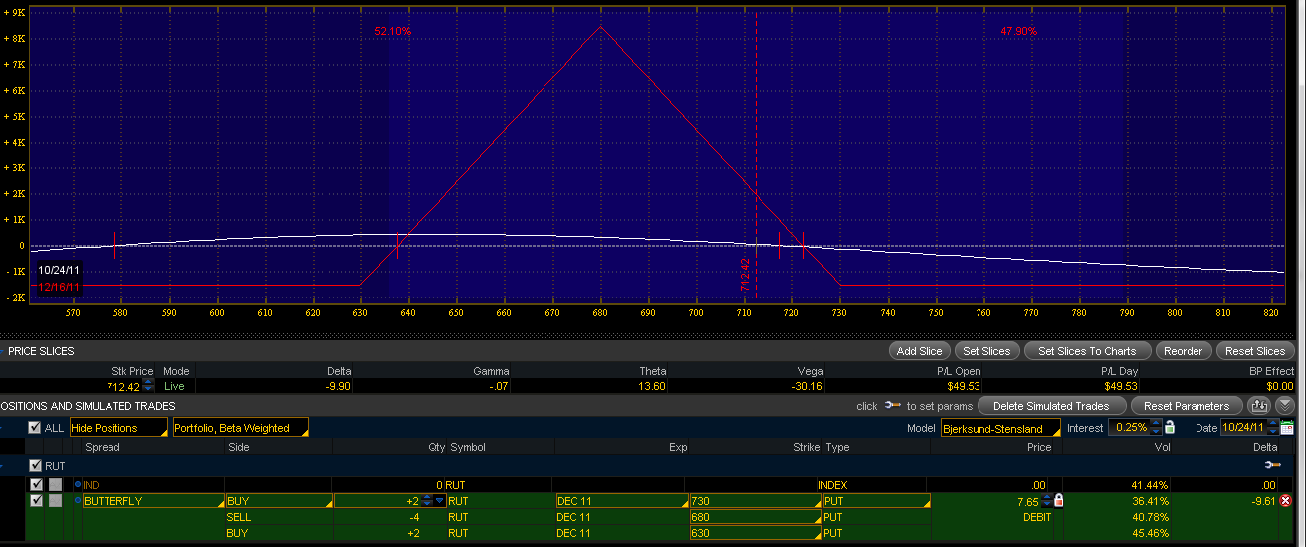

I initiated this trade on Friday October 21, 2011 by buying a 2 lot 630/680/730 put butterfly–behind the market, intentionally. As you will see, during most of this trade we will be staying behind the market, waiting for the inevitable pullback into “body” of the butterfly structure. The initial position is shown below:

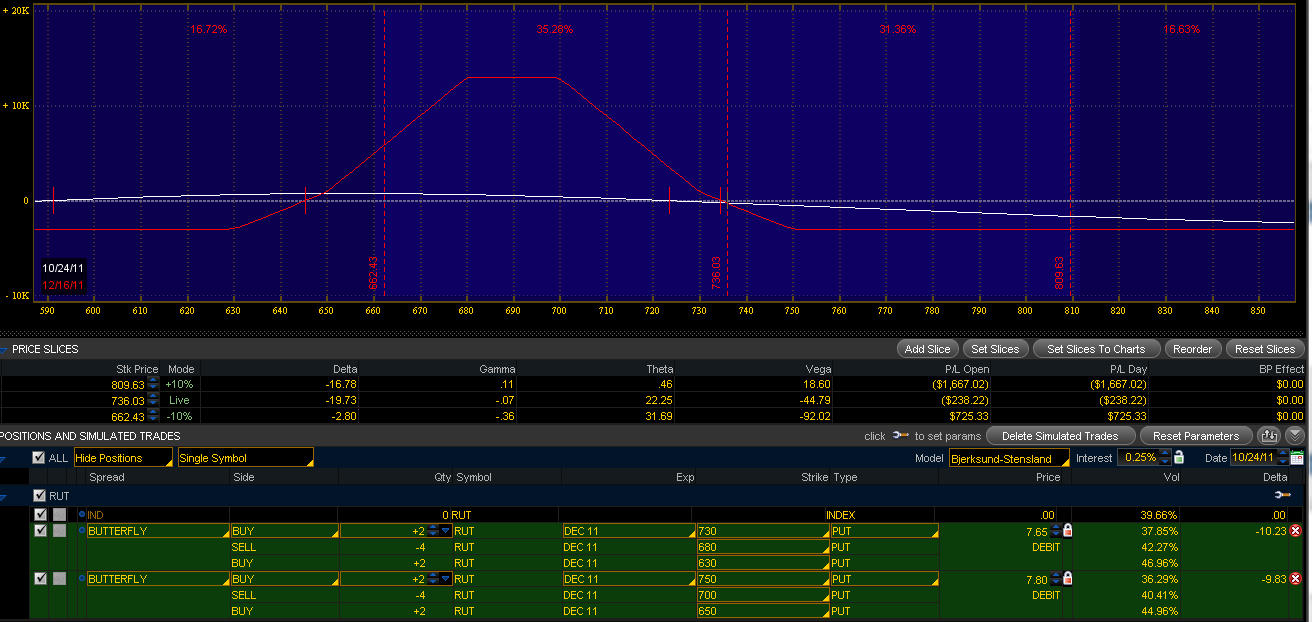

On Monday of last week I added the second butterfly to the trade according to our trading guidelines, again, intentionally behind the market. Specifically, I added a two lot 650 -700-750 put butterfly. The position was down $215 against a maximum loss of ($3000). The modified position is below:

Tomorrow we’ll discuss how we handled last Thursday’s monster rally.

As the market continues to play its hand, we have a plan for reacting to almost every scenario that you can think of. Keep checking back with us every day or so and we’ll publish each of our modifications to the trade as the saga of the December Bearish butterfly plays itself out. We look forward to taking this journey together with our loyal readers!

John Locke

Locke In Your Success, LLC

The SMB Options Training Program is a twelve month program designed for novice and intermediate level options traders who are seeking an intensive training process to learn how to trade options spreads for monthly income. For more information on this program contact Seth Freudberg: [email protected].