I work with a lot of traders trying to “make the turn” – that is the turn to consistently profitable. Among the plethora of issues preventing the average trader from being consistent, one has come up rather often recently.

The gap.

The gap between what you see as great opportunity at the end of the day, in hindsight; and what you were able to see at the hard right edge, in real time.

The more we can close that gap, the better traders we will be. I’d like to highlight a few key solutions you can apply immediately to help you get there. (Spoiler alert: they all require hard work.)

As with most trading improvements, the improvement in closing the gap comes from work outside of trading hours. Here, it’s all about adding some real solid steps to our daily review process. Review is an ambiguous term, and means different things to different people. My goal here will be to talk about a few specific things you can do in your review to help close the gap.

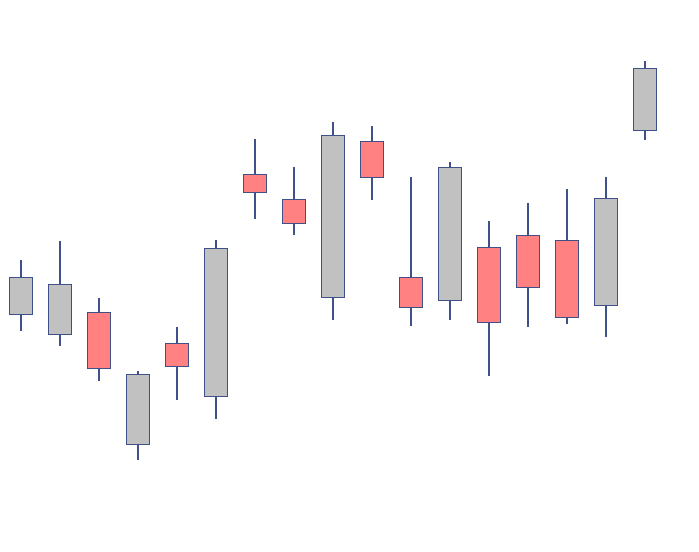

- Identify the best trade-able opportunities with the benefit of hindsight. That sounds easy on the surface, but it’s actually quite complex. Not every move up or down is a trade-able opportunity that you can find edge with. You’ve got to find patterns that work to give edge. Keep in mind that edge is made up of the frequency of wins (your win %), as well as the win:loss ratio (the average size of winners to that of losses). In other words, what we’re using these opportunities as is a perceptual framework for measuring risk:reward with an acceptable chance of that individual opportunity working out favorably.

- Identify what variables were present at the time of the opportunity – what you can genuinely identify in real time the next time they show up.

- Look to your journal/notes/recording to see what you were actually thinking/seeing/aware of at the time. Here’s actually one of the biggest chinks in the armor for many – they’re not actually journaling what they were thinking here and there. They cannot go back and compare what they thought, to what actually happened. Furthermore, one of the reasons this is so hard (including writing out premarket hypotheses and if/then statements) is because this forces you to put yourself out there. It forces you to be accountable to yourself. Most humans would rather hide behind the comfortable ambiguity, than go through the very uncomfortable confrontation in the mirror of seeing that your analysis actually sucks.

- Just because the market rallied 10 points from the lows DOES NOT mean that you should be kicking yourself for not buying those lows! You absolutely must accept that you A) cannot predict all price movement, B) don’t even need to predict that much anyways, and C) there will be places on the chart where there is nice strong movement that simply does not fit into the methods of viewing and trading the markets you have created. These three points could each be blog posts on their own.

- Figure out what you can focus on, what variable(s) you can monitor next time, to be able to successfully execute that trade. This is key for most people – some form of a checklist helps give you training wheels for a while until you internalize it. Most people are so lost with all the ticks up and down, and all the bells and whistles and flashing lights and numbers. Know what is your essential information for decision-making, and focus on that.

Essentially what we are doing here is a form of building a playbook. This is a critical work ethic, habit, and skill to develop. You cannot just “trade” as a discretionary intraday trader. You must build a book of plays/setups that make sense to you, in which you have clearly defined the essential variables present for identifying that trade opportunity in real time.

Furthermore, be realistic with your expectations. Do yourself a favor and find examples where all of your key variables are in check for the trade and the trade DOESN’T work out. There’s a small chance you may be able to add another filter to prevent some of the losing trades; there’s a much larger chance you cannot filter everything, you cannot predict everything, and you just need to do a better job of understanding that we’re all going to have losing trades. One of my biggest breakthroughs personally, was truly embracing that mindset of an uncertain outcome of each individual trade – and being ok with that fact.

-Merritt

*No relevant positions