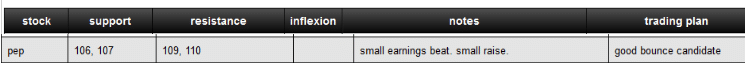

Each morning before the market opens we review stocks that have fresh news catalysts. We call these stocks “In Play”. When a stock has what appears to be a positive catalyst and yet is trading lower in the pre-market we take notice. Sometimes a stock with a positive catalyst will be trading lower because it has recently run up prior … Read More

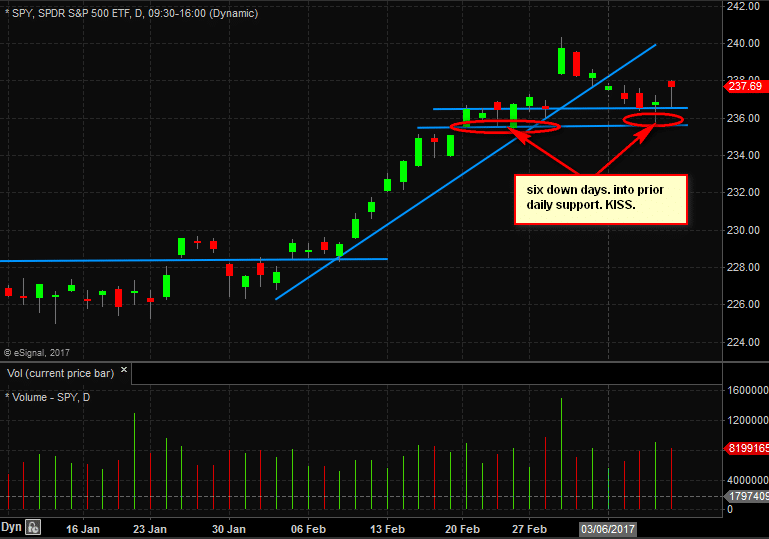

The Market Is Loosening Up

In this video I discuss how the character of the market has recently changed and how short term traders can capitalize by trading market ETFs such as SPY and futures contracts. no relevant positions Find out how you can get these ideas each morning and listen to our desk trade live below

How To Trade Large Gaps

In the following video I explain the process I use to develop initial bias and price targets in stocks that are gapping higher in the pre-market based on a catalyst. Also, below links to our live AM Meeting where I discussed each stock as our #1 In Play trading idea. The AM Meeting videos can give you a sense of … Read More

Morning Meeting April 5th

Each morning we discuss the overall market and the top In Play stocks to trade. Today, I offered my thoughts on why the SPY was setting up for higher prices (during first 2 minutes). Enjoy! (i did record meeting at home & yes that is my basset hound moving around in the background) For a Trial of our AM Meeting … Read More

Impossible Market Timing?

Wouldn’t it be great if we had a tool that gave us a heads up when market was making a short term top? What if that same tool could be used to time the bottom in market pull backs as well? If we had something like this surely we would make many millions of dollars if not billions in the … Read More

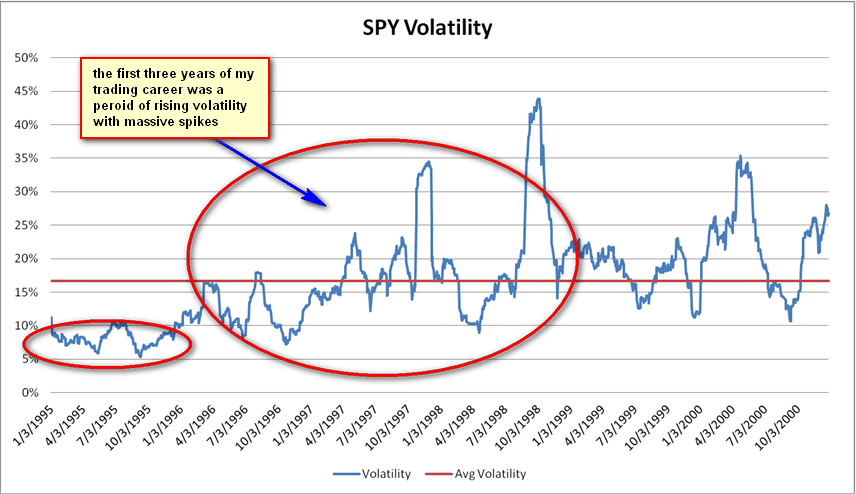

The End of Volatility

During the first three years of my trading career I participated in a stock market that seemed to move 1%+ almost every day. That market was built for short term traders. But during that same time period regulators pushed through a series of market structure changes that I believe laid the foundation for a long term decline in stock market … Read More

Sometimes Good News is The Best News To Short

Recently, an inexperienced trader asked me about a stock that traded lower after reporting great news. As any experienced trader will tell you, often that is a great opportunity to get short. Yesterday, Facebook reported amazing earnings with a slew of positive metrics. In the after hours it traded to a new all time high above 137. Yet, I got … Read More

Misery–Nothing Worked Today $CREE $STX $EAT

(1/25/17) Things didn’t work out so well today. Technically, EAT trade idea worked perfectly but I forgot to enter my “trading script” pre-market so I missed the short at 46, which worked perfectly trading down $2 to our first support area. It’s actually my second favorite setup for a stock reporting earnings: poor EPS & guidance that pops to well … Read More