“It’s better to be lucky than smart.” I’m not sure how that one got started, but I have to count that as one of the most foolish expressions in the English language. First off, what does it even mean? That if you have no intelligence or experience, that the only thing you have left is “luck” and you had better … Read More

Four Ways Market-Neutral Traders Can Benefit From Technical Analysis

Even though Market-Neutral Traders may not be picking a direction, we are dealing with price movement. Knowing what directional traders are thinking and where there are likely to be areas of high volatility can be extremely beneficial. Knowing the market conditions you’re entering into, in advance, can help you to modify your entry or avoid entering a trade that’s not … Read More

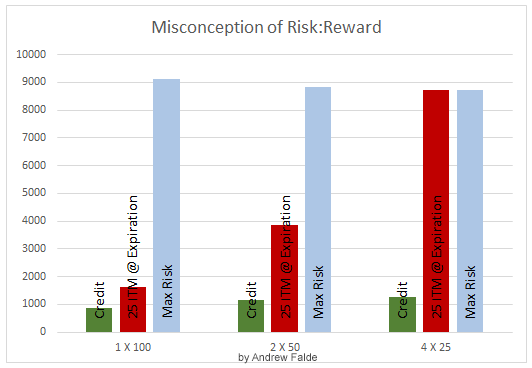

The Case for Wider Option Spreads

When analyzing a vertical based credit spread, including iron condors and butterflies, the first question that usually comes up is where to place the short strike. In a distant second usually comes the question of where to place the long strike, that is how wide the spread will be. This leaves some analysis to be done on using more contracts … Read More

The Importance of a Well-Thought-Out Trade Plan

Have you watched “Star Trek: The Next Generation”? One of my favorite episodes is when the Enterprise gets into a battle with The Borg. The USS Enterprise is getting hammered. Fires are breaking out, sparks are flying everywhere and people are running around screaming. Then there’s the Captain Picard, sitting in the Captains chair, confidently doing the tasks that will … Read More

Unveiling the Love Story of Options Trading: Confessions of an Options Geek

We had an ice storm on the East Coast this week that knocked my Internet service off the grid and shut down electricity throughout the area, and so I wandered through the city whose infrastructure had failed me as snow and ice fell around me. From home to office to a soccer-mom-filled Starbucks, I finally made it to my daughter’s … Read More

Risk Tolerance VS Risk Capacity

To be successful at trading, long term, it’s extremely important that our risk tolerance is in line with our risk capacity. Risk “tolerance” has to do with the amount of draw down we can withstand prior to the loss psychologically effecting our trading. Risk “capacity” has to do with the amount of draw down we can withstand prior to the … Read More

Trading with Fear and Anxiety

It’s important to understand the difference between fear and anxiety when we’re trading. Legitimate fear is our friend. Legitimate fear serves a warning to tell us something’s wrong. It’s the signal to be alert , to review our positions and plans. If we find something wrong, we can fix it. If not we let go of it and move on. … Read More

Six Reasons Traders Fail That Most Traders Don’t Think About

1. Lack of direction. Traders often fail to establish clear goals and create plans to achieve those goals. When traders fail to develop complete business and trading plans before entering the market they are setting themselves up for failure. 2. Impatience. This occurs when traders try to accomplish too much too soon, or expect to get results far faster than is truly possible. … Read More