Imagine a major league baseball game, where your favorite team gave up no runs for the first eight innings and then twelve runs in the ninth. Are you happy if the opposing team gave up one run in each inning of that same game? Of course not. The opposing team won 12-9. Yet the opposing team “lost” each of the … Read More

Traders Ask: How do I “repair” my deep in the money covered call option?

A reader asked us for help in the following situation: “I have a question and wonder if you will help. I would appreciate very much any advice that you can offer. I have 100 shares of GMCR stock and I have written a covered call– June ‘ 11/ strike 43– against it . The stock gapped up from 41 to … Read More

The Anthony Corporation Board of Directors

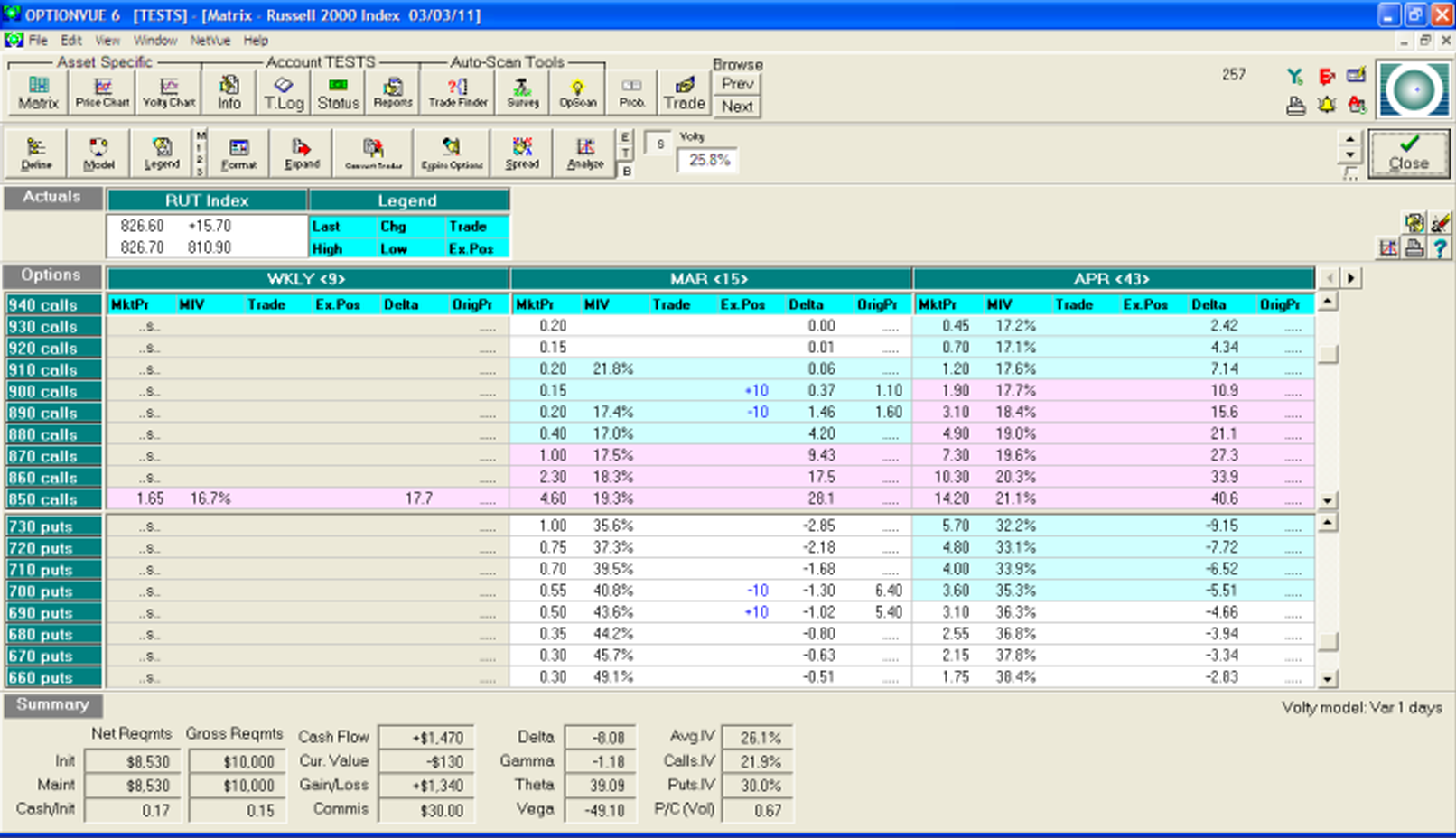

One of the most popular income options strategy is known as the high probability iron condor, which consists of a call side credit spread and a put side credit spread “facing each other” very far out of the money. For example, on January 19, 2011, at about 10:30 in the morning, the RUT Index was trading at 798. An options trader … Read More

What do all successful traders have in common?

In the summer of 2010, I traveled to Manhattan from my home in Philadelphia to meet with Roy Davis of SMB Capital for the purpose of checking out SMB’s intraday equities training program. While I am an income options spread trader myself, my premise was that intraday equities trading and options income trading were not at all mutually exclusive … Read More

Sometimes Nothing’s A Real Cool Hand

For those of you who are movie buffs like me, you’ll know that one of the truly greatest films of all time is Cool Hand Luke, the titlecharacter having been played by Paul Newman in one of his finest roles. If you haven’t seen it, see it. What a great flick. The Paul Newman character is a prisoner on a … Read More

The Right Way to Adopt a New Options Strategy for Your Playbook

In our last blog post we discussed the reasons that options traders should take it slowly when adopting a new income strategy. Here are some simple steps you can take to assure that your adoption of a new options strategy is sound: Communicate with the developer of the strategy and see if he or she is still actively trading the … Read More

Beware of the Fad: Five Reasons to Take it Easy with a New Options Strategy

In the options universe, there are plenty of traders who are happy to share a new strategy that has either worked well for them in the recent past, or has backtested splendidly over an extended period of time. Regardless of whether these strategies have been developed by competent veteran traders or newer traders who have not experienced every type of … Read More

Options Trade Initiation: Why Patience Pays Off

When developing traders enter into income options strategies, there is a tendency to become impatient when executing the opening trade. The trader will typically put an order in at or around the mid-price but often finds that the market is not biting on that price immediately. This can create anxiety and a feeling of impatience in the trader, arising from the belief that, since almost … Read More