I mentioned last week that I would blog the next time I took a rip of more than 1K. Unfortunately, I ripped up a lot more than that today. There were several reasons why I took this unnecessary loss and they were all my fault. Sometimes as a trader you will take a large loss due to market circumstances. But the reality is that most times a trader takes a large loss it is due to trading error.

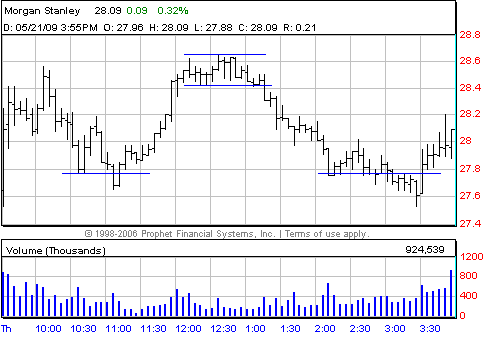

My rip today was in MS. What even makes the rip more painful is that I caught a great move off of the bottom from 10:30AM and was up a lot of money in it. If you look at the chart below you can see that after a strong move up from 27.77 that MS was consolidating at the high of the day. I was long 5K shares for pretty much the entire up move. We discussed in our AM Meeting that yesterday afternoon MS was unable to rally above 28.70 so I knew to be careful as it approached this level.

My plan was to hit out of my long if the 28.45 bid dropped and look to get long again around 28.20. I followed the part of my plan which required me to hit out of my long. I was still up more than 2K in the stock at that point. My first mistake was buying in the 28.30s. My reasoning was that there wasn’t much of a down move when the 28.40 bid dropped so I should try to get back in. Wrong! The stock had just broken to the downside after a long period of consolidation. I should have been more patient to see how far it would drop.

Mistake number two was getting long far too many shares as it approached the 28 level. I should have only nibbled at this level. I should have waited for a held bid above 28 to add more size. I was in a position of weakness by having a huge position before MS firmly established support or began a new uptrend. I was long 8K shares and hit them all when the 28 bid dropped. As you can see from the chart it wasn’t such a good sale. The stock immediately popped to 28.18. Obviously a sale on 8K shares at 27.98 is not as good as a sale in the 28.10s. If I had the proper size at the 28 level I would have given MS a little more room on the downside before I hit it and easily could have exited my position when it failed to trade above the 28.20 resistance. (1K+ rip)

Mistake number three was buying a large position back twenty minutes later when it pulled back to the 28 level again. The reality in the stock was that after a 60 cent down move it had consolidated very close to its recent low. When it began ticking lower I should have either a) been short or b) waited to see if it failed to hold below the 28 level before getting long.

Mistake number four was not hitting the large position I just bought at 28 when the 27.97 bid dropped. (1.5K rip)

Mistakes number five and six were not covering my too large short quickly when I got short below the 11:00AM low of 28.65. I had an opportunity to cover for a small loss but instead I waited until 28.75. I recognized that when MS was trading below 28.65 that it was extremely difficult to get hit on the bid. If there were committed sellers my bids below 28.65 would have been hit. (1K rip)

There were a few more mistakes in there that resulted in additional losses of 2K. So when all was said and done it was a pretty miserable day for me. But the misery was self inflicted. There was plenty of money in MS today. But the money was only available for about 6 very well defined trades. Unfortunately, I only made 2 of those 6 trades as well as a lot of other poor risk/reward trades.

The good news is that my mistakes are easily correctable and I now have information on some very important price points for tomorrow. I will trade with 50% less size tomorrow and only make trades at the most important intraday prices. Major inflection points to watch in MS tomorrow are 27.5, 27.75, 28.20, 28.60-28.70, 29.6.

Don’t forget to follow us on twitter.