What is risk?

Imagine a word that everyone threw around constantly, but that no one could define. A word that was critically important, but never used properly.

In trading, that word is “risk”.

Of course, we have to use the word constantly. We are taking risk in order to generate a return. We put on positions and make sound decisions in order to make money. With trying to make money, there is inevitably some downside—naturally, we could lose money or we could make it. “No pain, no gain”—or in this context, “no risk, no return”.

We probably don’t want to lose any money. Inevitably, there will be a losing trade or even a sustained drawdown. When you are taking risk, there is always the chance that something could go awry. Something could even go seriously wrong—for instance, the stock you bought today could theoretically drop a huge amount tomorrow

One solution to the problem risk is never to take any risk. We could always just stash our money in the bank and never invest or trade again. We could dig a hole and bury our money there. Or we could just stick our head in the proverbial sand.

However, if we are active traders or investors, that isn’t the solution to the problem. Instead, we need to understand to risk better, in order to take it when prudent yet avoid taking too much of it.

Defining Risk

In order to have an intelligent discussion about risk, we need to define it first. There are a bunch of competing definitions floating around, so let’s examine them first.

The most obvious kind of risk is loss of capital. You put on a position and you could either make or lose money. Most people are looking to make money and quite sensibly don’t want to lose it. They fear the loss of capital. They would stop trading entirely if they lose too much money, or if they were losing too frequently. Thus, most people would define risk as the chance to lose money— and ideally the potential returns would compensate for any potential loss of capital.

It’s interesting that this differs substantially from the academic definition of risk. Most textbooks and finance gurus define risk as volatility—i.e. the fluctuations in your positions and their returns. The higher volatility, then the higher the potential returns and losses. Thus, if you experience a drawdown, it would probably be bigger if volatility was higher.

The weakness in this view is that some people have volatile trading strategies which also happen to be very profitable. George Soros’ return series is quite lumpy, showing big swings in profit and loss, but he has produced tremendous overall returns. The same goes for Warren Buffet. Their compounded returns are simply amazing. Let’s face it– you would take 30% returns per year, even if they had the occasional large drawdown. You would probably prefer that to a fund that had no volatility but could only ever generate a return of 3%. You are worried about generating returns, not necessarily with the volatility that goes with them. You are quite happy to take bigger risks if you are rewarded appropriately—as George Soros demonstrates quite well. He can provide you with billions of reasons why volatility is a misnomer.

But if you ask a mutual fund manager, he is worried about something completely different—outperforming his benchmark. If the market is up 15%, he should be up more than 15%. And if the market is down 20% and he is down only 8%, then he is a superstar—yes, even if he has lost money! What keeps him up at night is the chance that the market is up 20% and he is only up 10%– then he could face the threat of being fired. In his position, he would define risk as the failure to outperform his benchmark. He will take positions relative to the index (i.e. under or overweighting specific stocks) in order to hopefully generate outperformance, with the risk that he fails to.

And if you ask a third person, who manages the endowment of a major university, he has an entirely different goal—to beat inflation. Because the endowment is supposed to support the university’s operations and to last forever, it has to preserve its purchasing power. An endowment could generate positive returns year over year but still not keep up with inflation, which would be a disaster. In this case, the manager would define risk as the inability to keep up with inflation.

What do all three have in common? They define risk as the failure to reach your objective—whatever your own objective is. If your goal is to make money, then a possible loss of capital is a risk. If your goal is to beat inflation, then risk is the failure to keep up with inflation, even if you make money. Obviously, As you progress through your career or experiences in the markets, then most likely your objectives will shift. But one thing will remain the same—risk will be the possibility of not meeting your objectives.

What Does This Mean?

What are the implications of this new definition of risk? The first is that we need to recalibrate how we think about taking risk. In the academic definition, risk is volatility—which means that you weigh returns versus their standard deviation. In this model, you prize consistent but low returns over volatile but high returns—as the former look to be a better “risk-adjusted” bet. But your tolerance for volatility depends on your objectives. Some people would love to have high returns even if they were lumpy.

Instead, we need to begin evaluating investment decisions in a new light: the probability of getting closer to our objective and the gains that that entails, versus the chance of failing and the costs. With an individual investor’s retirement portfolio, we do this naturally. When putting on a position, you look for something that can generate positive returns, and hopefully make a big positive contribution; but you keep the position small enough so that if you get it wrong and it becomes a loser, then you don’t get blown up.

As a matter of fact, most people understand this intuitively—that’s why we don’t put our entire investment portfolios into one stock nor do we “bet the farm” on one levered forex position. But how does this look for an investor with different objectives? For the mutual fund manager, his goal is to outperform the benchmark. He would select positions that can outperform the benchmark—either ones that have a high probability of outperforming the benchmark by a decent margin, or for positions that have a decent chance of outperforming the index by a wide margin. On the flipside, these positions should either have a low probability of underperforming the benchmark by a decent margin, or they should have a tiny probability of underperforming the benchmark. That way, the manager can be assured that each individual position will, on balance, contribute to him outperforming the benchmark and that no single position will lead to him massively underperforming the benchmark. With each investment, he has to focus on his objective and balance the possibility of outperforming versus the risk that a position underperforms.

Once we start thinking about risk as the inability to meet our investment goals, then we have to rethink how we put on individual positions. Keeping our objectives in sight, we need to weigh carefully the chances that a position “works” versus it “not working”—and to think about what we gain or lose in each case.

Measuring It

Now that we understand how to approach risk in a new way, let’s walk through a couple examples. In each of these, we are using a statistical approach, whereby we weigh the probability of a certain outcome happening versus the quantified impact. We want to balance the two so that each bet has a statistically positive outcome, i.e. that each position we are taking, net-net, is moving us closer to our goals.

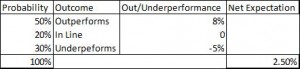

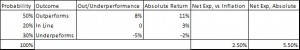

Imagine the mutual fund manager, who is striving to beat his benchmark. His investment process is to look for stocks with a greater than 50% chance of outperforming the index, but where he won’t disastrously underperform if he turns out to be wrong. On each bet, he has a statistically positive expectation—each bet should outperform the market.

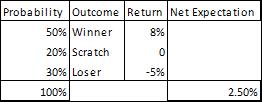

If each investment has a 50% chance of outperforming the market by 8% versus a 30% chance of underperforming the market by 5%, then you can expect that he will generate an outperformance of 2.5% on average.

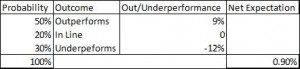

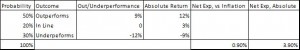

If we fiddle with the numbers, then we can see a clear deterioration. Just tweaking the average outperformance to 9%, and the average underperformer to -12%, then the net expectation drops to only 0.9%.

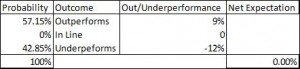

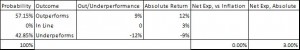

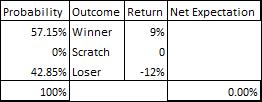

The numbers look even worse if we change the weightings of each outcome. If we boost the chance of both underperformance and outperformance, while removing the chance of “in-line”, then we drop to 0% net expectation. That means that, in aggregate, we will find it difficult to outperform the benchmark at all.

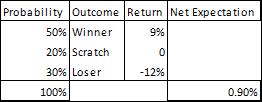

For endowment managers, whose goal is to beat inflation, they will have a very similar decision-making framework. They have to evaluate each investment versus their benchmark. Even if they generate OK absolute returns, they could still underperform their benchmark, which would be a disappointment. Below, we use the same range of probabilities and outcomes versus the benchmark; but we also add in a 3% inflation assumption and proceed to compare their absolute returns as opposed to the returns versus the objective.

These are the same tables just for absolute return, whereby you are investing and trying to generate a positive return. Once again, if you don’t limit losses quickly enough, or if your proportion of losers is too high, then you can see your returns quickly converge to 0.

Taking the Right Amount of Risk

This statistical framework should give you the tools to take the right amount of risk. Once you learn to think about risk as the chance of not meeting your objectives, then you can refocus your investment process. You can begin to evaluate every position by weighing everything versus your objectives. With research and also with experience, you should be able to quantify the probabilities of various outcomes and their impact. Make sure to take only bets where you can be reasonably assured of a positive statistical outcome, i.e. so that each bet will get you closer to your goal.

Here are some other thoughts about risk:

Always think in terms of your goals versus the risk of not getting there—investing and trading requires taking risk. Where you’re investing in the stock market or day trading currencies, you have to take risk to generate returns. With this in mind, don’t think about avoiding risk – instead, look to get a good return trade-off versus the risks taken.

Never, ever take a risk that would mean you never accomplish your objectives—if you’re saving for retirement, a 90% drawdown is catastrophic. If you’re a mutual fund manager, underperforming your benchmark by 30% in a year is a disaster. No matter what you do, never take a position with so much risk that it would singlehandedly prevent you from ever reaching your goal. For instance, don’t sell lots of downside puts, because that would blow you up in a crash scenario; if you are benchmarked against inflation, always have some hedge against inflation or an asset whose value will rise with inflation, so that you can’t fall terribly behind your objective.

The costs of not accomplishing your objective can shift over time—consider the case of someone’s retirement account. If you are a young individual who is investing in order to save for retirement, then you are also looking for a lumpy but positive return profile. You are willing to take more risk now in order to generate higher long-term returns and to have a decent chance that your nest egg will be big by the time you end up retiring. If you are approaching retirement, then you would want to shift to a more conservative asset mix, because if you take a big hit in your portfolio, then you might never have enough to retire successfully.

Work on your investment process to boost statistical expectation—There are two ways to boost your overall statistical expectation—the first is to boost your overall winning rate, so that you are having more winners and fewer losers. The other way is to have bigger wins when you do win, and smaller losses when you do lose. In order to boost your win rate, you want to review your previous trades and to discover which setups and exits work and how frequently. Then, cut out all but the highest percentage entries and exits. For boosting win rates, you want to do the same – to figure out which setups and exits lead to the biggest profits versus loss. Another good thing to do is to figure out if you need to hold positions for a longer or shorter period of time. Sometimes, we have the right idea when we get in but get out too soon, thereby preventing us from really maximizing our profits. Or we hold onto positions forever, even after the investment thesis has played out, leading to lower overall profits. Only you can know that the right answer is.

Conclusion:

Risk is the one thing that’s constantly on traders’ minds. Nevertheless, people may not always have a clear idea of what risk is and of how it plays into investment decisions. Hopefully you have realized that risk is the failure to accomplish your investment objectives and are prepared to strive to meet your objectives. In order to be a great trader or investor, you need to take the right amount of risk and always to balance the pursuit of your objectives with the chance of failure. I hope that this decision-making framework leads you to greater success in the markets.

By Bruce Bower | E-mail: Bruce [at] howoftrading.com

Blog: www.howoftrading.com | Twitter: @HowOfTrading