Traders want to become Steve Cohen TODAY! This can lead to starting too fast for all levels of traders at all different stages of their careers. My advise based on experience working with pro traders in NYC? Slow down! At our firm we hire experienced discretionary and quant traders with a track record. We fully back the traders taking all … Read More

Less is More

As I sit here looking at the 400 emails I’ve gotten this morning, I’m reminded of the massive amount of information we need to sift through on a daily basis and how all that information affects our journey as traders. I grew up with the belief that” knowing everything I could know” about a subject was a good thing. After … Read More

Trading Made Easier- $SSYS $THOR

Trader Development has started for our newest class of traders. After they complete the SMB Foundation, they trade live and take Trader Development. We are making a special effort with this class to keep things simple. If you were teaching someone to play basketball would you teach them first how to make turnaround 3 point shots? No you would have them … Read More

Recording: Paul Forchione: Optionvue Systems, International: Finding Butterfly and ‘Calendarized Butterfly’ Opportunities

Paul Forchione of Optionvue Systems, International returns to the Options Tribe to discuss ways to unearth opportunities for out of the money butterflies and ‘calendarized butterflies’ for directional options plays. Enjoy the video! Risk Disclaimer no relevant positions

A Visit to the Prop Desk- @allstarcharts (Video)

JC Parets, @allstarcharts, is a market technician and stopped by SMB Capital to chat with our College Training Program students and newest traders about the benefits of technical analysis. He is a regular guest on CNBC, Bloomberg, Business News Network, Wall Street Journal and Yahoo Finance among other financial media outlets. One of our traders summarized the key concepts that … Read More

How Memory Affects Your Trading

The emotions we feel and the actions we take are largely dependent on how we remember things. This is because we use our memories to learn. We might think something like “I remember the last time this happened. I did that and got a favorable result, therefore I will do that again.” The challenge however, is that our memories aren’t … Read More

Options Trading for Income with John Locke for August 4, 2014

Risk Disclosure No relevant positions John Locke – www.lockeinyoursuccess.com

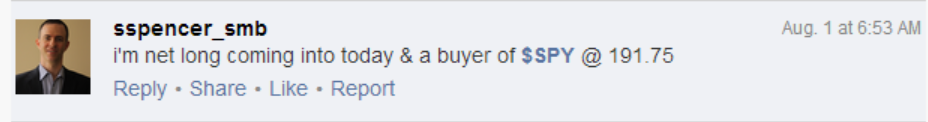

Trading Lesson–How To Trade When The Market Is “In Play”

Short term traders can greatly increase their risk/reward and win rate by making sure that they are in the most “In Play” names each day. Occasionally, the market itself becomes “In Play” following a major technical break and I will trade it via index ETFs. Friday morning I shared a price on StockTwits I wanted to get long the market … Read More