The counter-trend trade has been the trade of the year thus far in the market. The trade is expressed via a long position in the SPY after a down move to recent support. The idea behind this trade is the market has a strong underlying bid and when it pulls back to a prior support level buyers will step into … Read More

How Are Those New Year’s Resolutions Going?

Maybe it’s the bubbles in champagne, or the sound of the cork popping, but New Year’s always brings out a rush of emotions. The end of one year naturally lends itself to reflection on the past. As the calendar turns over, people wax lyrical about another year passing. Taking stock of the past year, people figure out where they are … Read More

Not So Fast

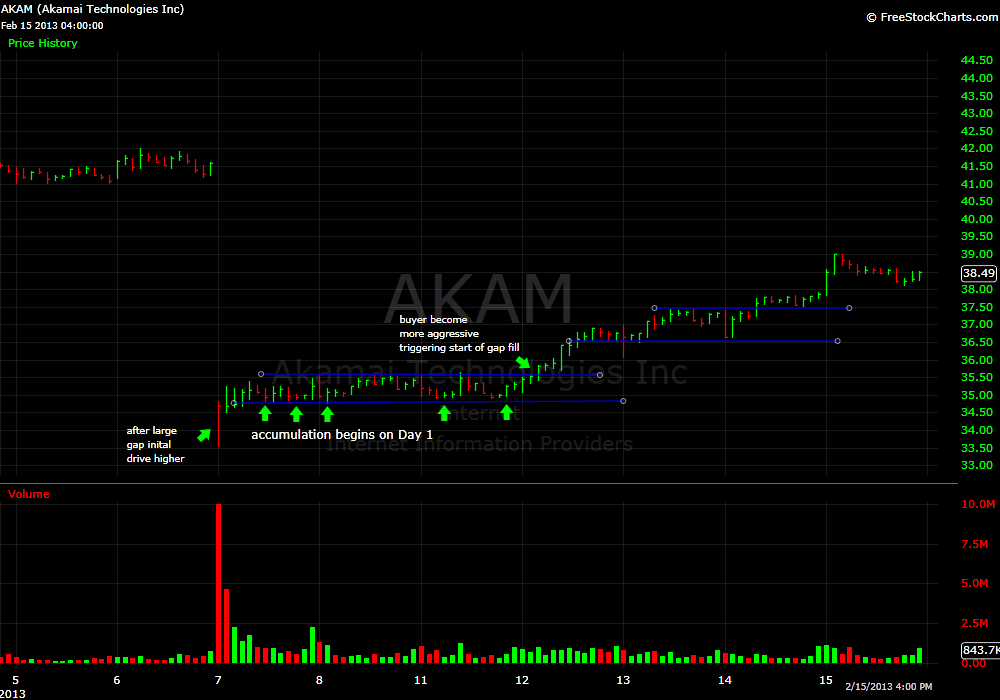

One of the more common patterns seen in a strong market are longer term players buying stocks that have gapped lower after earnings. Sometimes this plays out on Day 1 with momentum buyers aggressively buying the stock leading to a gap fill. But many times a gap fill will play out in the days following the earnings release once the … Read More

Recording: Seth Freudberg: Heart Friendly Butterfly Review

SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading. In this presentation, Seth Freudberg reviewed the Heart Friendly … Read More

Learn To Take A Loss

I was trading GMCR this morning. I consider it to be a Top 8 “momo” stock. It would probably be #2 behind NFLX if it hadn’t done a dopey 3/1 stock split a couple of years ago. “Momo” stocks are stocks that “fast money” hedge funds are constantly pushing around. GMCR gapped lower on earnings last week and had a … Read More

One-trick pony in many products or master of one?

Hello Mike, I hope that my email finds you well. I wanted to get your thoughts on the following: What works best? Mastering one set up and trading multiple instruments/stocks/etc… or trading multiple set up’s on one instrument/stock? Is this something that depends on the trader? Your thoughts? BELLA Gr8 question! In my next book The PlayBook, which you can … Read More

How you can determine how far a stock will move

Bella, I was wondering if you had any tips on figuring out when to ignore the ATR on a stock keep looking for entries. AVP was a stock I thought I had traded well at the time given that it was already overextended at the time. It has an ATR of 0.4 yet in the end it moved well over … Read More

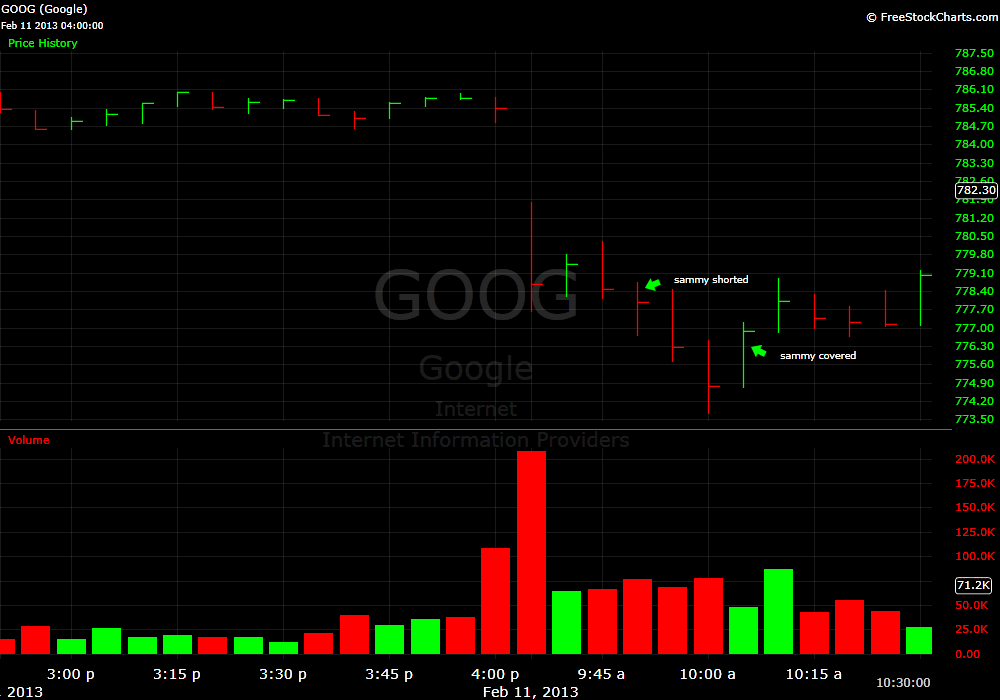

Should Short Term Traders Consider Fundamentals–Part II

In Part I of this series I discussed whether understanding the news could help short term traders limit their risk on overnight positions. Today’s post discusses whether understanding the news gives a short term trader a possible edge in determining profit targets and when to exit an intraday position. As examples I will use two trades that Sammy, an SMB … Read More